OTTAWA – A new study by the Canadian Centre for Policy Alternatives says there is plenty of room to raise taxes on the richest one per cent of the population and still leave their tax rates lower than they were 40 years ago.

The incoming Liberal government has proposed raising the top marginal income tax rate on those earning $200,000 or more.

That’s easily doable, the study says.

It says Canada, on average, has become a low-tax jurisdiction for the affluent compared with the U.S.

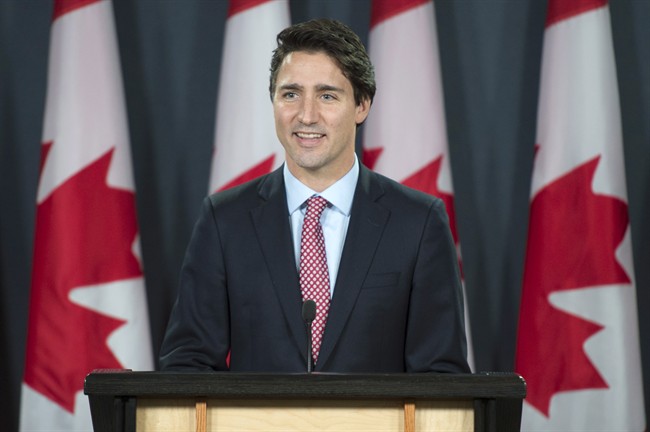

WATCH: Justin Trudeau talks about why he plans to raise taxes on wealthiest 1% of Canadians

Even with provincial income tax added to federal income tax, the average total top marginal tax rate on labour income was 45.7 per cent in 2013.

That compares with an average top marginal income tax rate of 47.9 per cent across American states.

“The top marginal income tax rate has been well over 50 per cent for most of the time Canada has had an income tax,” said Lars Osberg, a research associate with the policy think tank.

“In fact, during Canada’s high growth years between 1940 and 1980, the top marginal income tax rate was well over 70 per cent. Now the top federal income tax rate is 29 per cent.

“Our federal government used to ask more of Canada’s richest one per cent. There are plenty of reasons to do so again.”

The report said there is little evidence that higher taxes will drive the wealthy out of the country. And, it adds, there are potentially billions of dollars in revenues to be had by raising taxes on the rich.

A new, 65 per cent marginal tax rate for income in excess of $205,000 would yield between $15.8 billion and $19.3 billion, it said.

WATCH: Trudeau says Harper claiming Liberals will raise taxes is an ‘attack based on untruths’

Under that regime, a person in the top one per cent of earners with taxable income of $289,000 would see a $27,000 increase, on average, in taxes.

“To put these revenue gains in context, in 2012-13 the total tuition revenue of Canada’s colleges and universities was $8.1 billion and federal infrastructure spending was $5 billion,” the report said.

- Canadian man dies during Texas Ironman event. His widow wants answers as to why

- ‘Shock and disbelief’ after Manitoba school trustee’s Indigenous comments

- Several baby products have been recalled by Health Canada. Here’s the list

- ‘Sciatica was gone’: hospital performs robot-assisted spinal surgery in Canadian first

Comments